Wells Fargo Life Insurance With Checking Account

You can learn more about the wells fargo promotions to see how to get it. Everyday checking, preferred checking, portfolio by wells fargo, teen checking, and opportunity checking.

Wells Fargo Life Insurance Review History Alternatives

The minimum balance and transfer requirements to waive fees are also much lower than competitors with similar accounts.

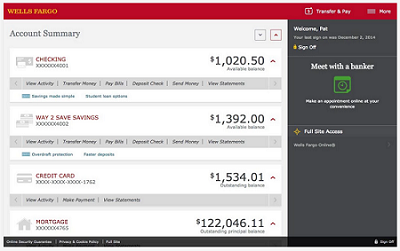

Wells fargo life insurance with checking account. Wells fargo has a nationwide promotion of $200 for a new checking account when you open a new checking account with at least $25 and receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening. The opening deposit for this wells fargo checking account is $25. This account charges a monthly service fee of up to $10, but the fee is waived if you keep a minimum balance of $500 or have a monthly direct deposit of $500.

News of the fraud became widely known in late 2016 after various regulatory bodies, including the consumer financial protection bureau, fined the company a combined us$185 million as a result of the illegal. Wells fargo makes it easy to afford a checking and savings account with low monthly fees and numerous ways to waive these fees. If you convert from a wells fargo account with check writing ability to a clear access banking account, any outstanding check(s) presented on the new clear access banking account on or after the date of conversion will be returned unpaid.

This is wells fargo’s most popular checking account option. Manage your account and pay online. Buying life insurance when you are already at the bank is convenient.

The payee may charge additional fees when the check is returned. Monthly service fee for portfolio by wells fargo. Deposit products (such as cds and savings accounts) held in iras and other retirement accounts

Their traditional life insurance is through a third party broker that offers only 3 companies to compare with. Everyday checking is their most popular account and offers many options to avoid the monthly service fee. Even though you cannot get life insurance at a convenient wells fargo kiosk at the moment, you never know when that may change.

All five checking accounts offer free mobile and online. In summary here is what you need to know about getting life insurance with wells fargo: Atm fee, $2.50 for every cash.

Enrollment with zelle ® through wells fargo online ® or wells fargo business online ® is required. Tinder, the dating equivalent of trying on a bunch of different pairs of pants before giving up and eating some cheese fries, just announced a new feature called swipe the vote. For your protection, zelle ® should only be used for sending money to friends, family, or others you.

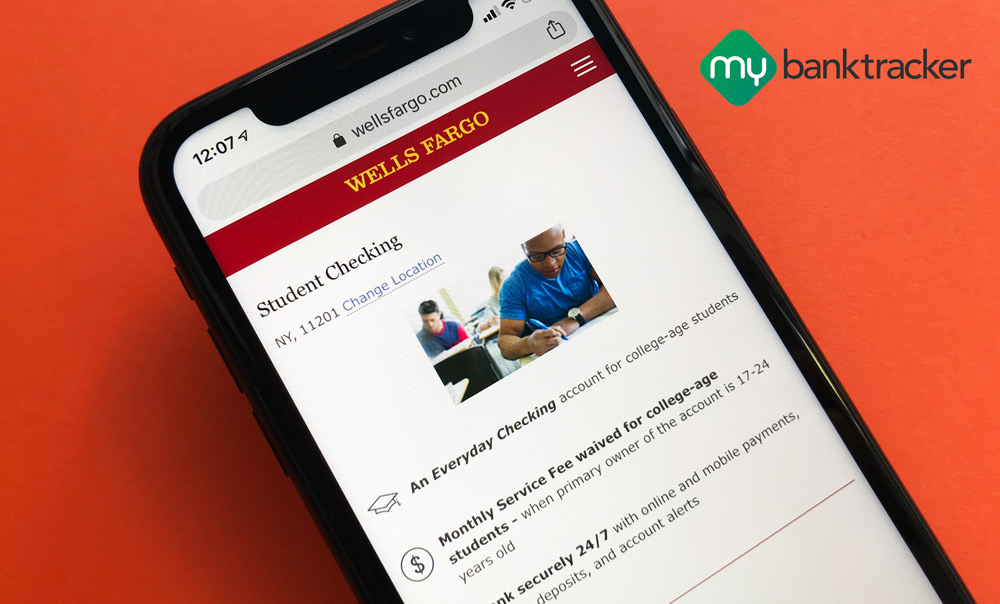

Learn more about wells fargo online ® It is a good fit for customers looking for a convenient bank account, those with lower balances and college students. However, typically, your bank will only offer a few life insurance.

Any discussion of taxes represents general information and is not intended to be, nor should it be construed to be, legal or tax advice. Wells fargo advisors is not a legal or tax advisor. The wells fargo account fraud scandal is a controversy brought about by the creation of millions of fraudulent savings and checking accounts on behalf of wells fargo clients without their consent.

Checking or savings account required to use zelle ®. Your money’s at hand with everyday checking. Their simplified issue product is through prudential life insurance company with no ability to compare with other no exam carriers.

Of linked bank deposit or investment accounts. Wells fargo offers 5 types of checking accounts: Linking together a wells fargo checking account with your way2save® account also allows you to use your savings account for overdraft protection.

All three wells fargo business checking accounts carry a monthly maintenance fee, ranging from $10 to $75 per month, depending on the account… The maystrenkos filed suit in january, after wells fargo refused to approve them for a credit card, personal loan or a checking account. All types of deposits held at wells fargo bank are covered by fdic insurance including the following examples:

Quick view of account fees (pdf) : Insurance can be used to help you achieve your goals while you are still alive and well. If you’re saving monthly, the deposit has to be at least $25, with the daily minimum set at $1.

Everyday checking is the basic checking account available from wells fargo. Life insurance as a financial tool. For wealth and investment management clients, contact your financial advisor or relationship manager, or call:

Overdraft protection, $12.50 per transfer from a linked wells fargo savings account or line of credit account, such as a credit card. Wells fargo doesn’t actually offer their own life insurance product. Transactions between enrolled users typically occur in minutes.

Insurance can also be used during your lifetime to:

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Vs Bank Of America Checking Accounts 2021 Review Which Is Better Mybanktracker

Wells Fargo Student Checking Account 2021 Review - Should You Open Mybanktracker

Wells Fargo Online Banking Features And Benefits

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Bank Review Smartassetcom

Wells Fargo Mobile Iphone App - App Store Apps

Wells Fargo Mobile Iphone App - App Store Apps

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Mortgage Review 2021 Smartassetcom

How To Avoid Wells Fargo Checking Account Fees Mybanktracker

Wells Fargo Life Insurance Review - Insurechancecom

How To Send Money From Us Bank To Wells Fargo - Everythingbanksnet

Bank Account Balance Wells Fargo Account Accounting

Wells Fargo Mobile - Aplikasi Di Google Play

Wells Fargo Wells Fargo Account Wells Fargo Gratitude Board

Wells Fargo 2 Wells Fargo Account Wells Fargo Wells Fargo Checking

Posting Komentar untuk "Wells Fargo Life Insurance With Checking Account"