General Aggregate Insurance Definition

While not often used in property insurance, aggregates are sometimes included with respect to certain. Cgl insurance policies carry liability limits, which means that during the term of coverage, the insurance will pay only up to a certain amount.once the policy reaches those thresholds, its financial resources are exhausted.

A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy.

General aggregate insurance definition. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. This is a contractual clause and may also be referred to as a general aggregate limit. The aggregate insurance definition is the most your policy will pay for all losses you sustain over a given period of time, usually a year.

General liability insurance business owners typically deal with aggregate insurance coverage in their general liability insurance policy. This is different than a per occurrence limit, which is the maximum amount the policy pays out per claim levied against you within the term of your policy. Key takeaways an aggregate limit caps the total amount that an insurer will pay a policyholder for a set time.

Liability insurance policies also include a limit for the aggregate of all of your claims. Compare small business insurance quotes from top u.s. Suggest as a translation of general aggregate.

General liability is designed to cover the costs of a legal defense and pay damages if a company is found liable. In general, the appropriate definition of a monetary aggregate largely depends on the purpose for which the aggregate is. General aggregate in insurance is the total amount that you can claim from your insurance company within the period of the policy, which is usually one year.

Aggregate also is referred to as an aggregate limit or general aggregate limit. This coverage is extra important to understand when liability lawsuits are so frequent. The aggregate helps the insurance company create an incentive for its policyholders to avoid lawsuits.

The limit of coverage shown next to the term “general aggregate” is an annual maximum amount payable in the event of more than one claim event. As already described in the previous section, the general aggregate limit of your insurance policy caps the maximum payout on. In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe.

Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. Most policy periods are one year. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

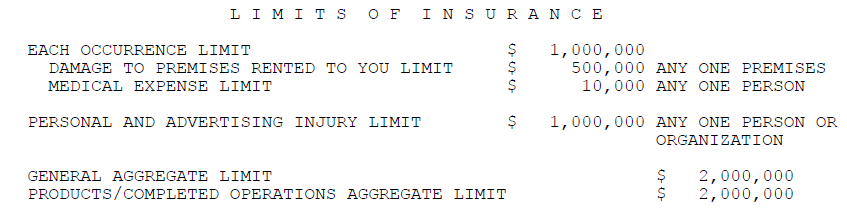

Your insurance agent may mention a per occurrence limit or an aggregate limit, they may appear on paper in the following form: General aggregate and per occurrence are two common ways insurance companies define the limits of their financial responsibility to a policyholder. Two important limits include “each occurrence” and “general aggregate”:

• set formal company policy for contracts, insurance requirements, and business relationships. In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. With general liability insurance, aggregate limits are known as general aggregate limits.

Aggregate limits are a policy feature that meets the needs of both insurance customers and insurance. That might represent a single large claim, or multiple smaller ones. The policy contract defines your coverage limits, parameters, and policy period.

$1,000,000 each occurrence/$1,000,000 products and completed operations aggregate & general aggregate the following are some of the more important elements of a program to help control contractual liability losses: A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Why are aggregate limits necessary?

Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. This is a separate aggregate limit and claims of this nature will not diminish the general aggregate limit but is still subject to the per occurrence limit for each claim. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit.

The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term. The aggregate limits are part of commercial general. Aggregate limits are commonly included in liability policies.

The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. General insurance is the umbrella term used by the insurance industry to describe all policies other than life insurance policies. The most prominent limit is the “occurrence limit.” this is the amount that’s available for each individual occurrence during the policy.

3) personal & advertising injury limit: Commercial general liability insurance policies include various limits of liability. In insurance speak, personal injury refers to slander, libel, invasion of.

Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for. Typically, the aggregate limit is two or three times […] General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

Aggregate — (1) a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time, usually a year.

Professional Liability Are Contractors Adequately Protected Expert Commentary Irmicom

The Corridor Self-insured Retention Expert Commentary Irmicom

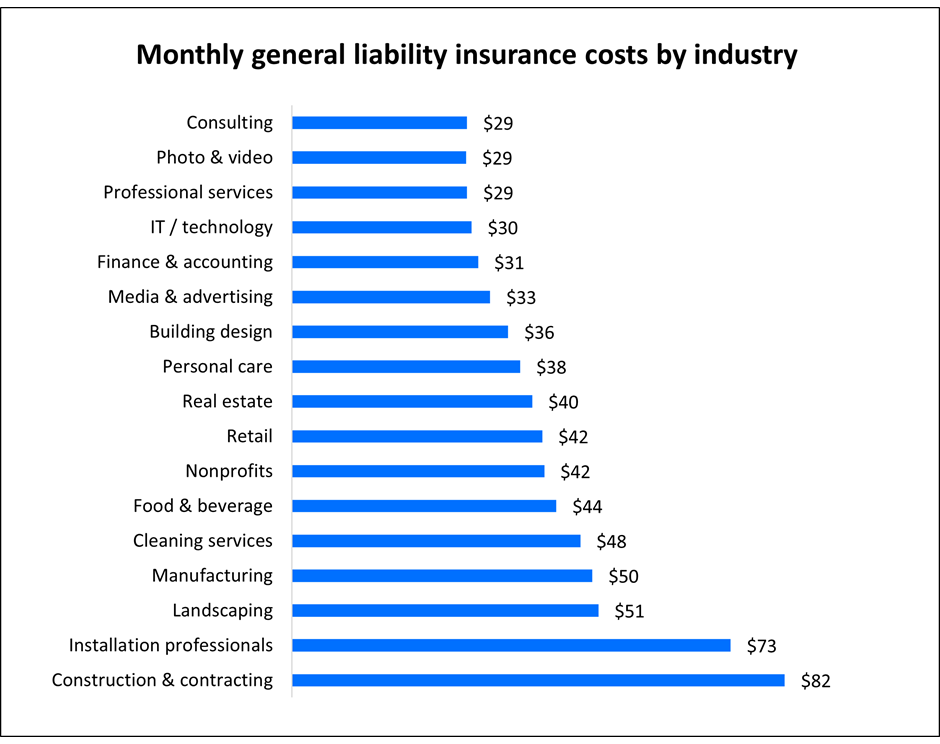

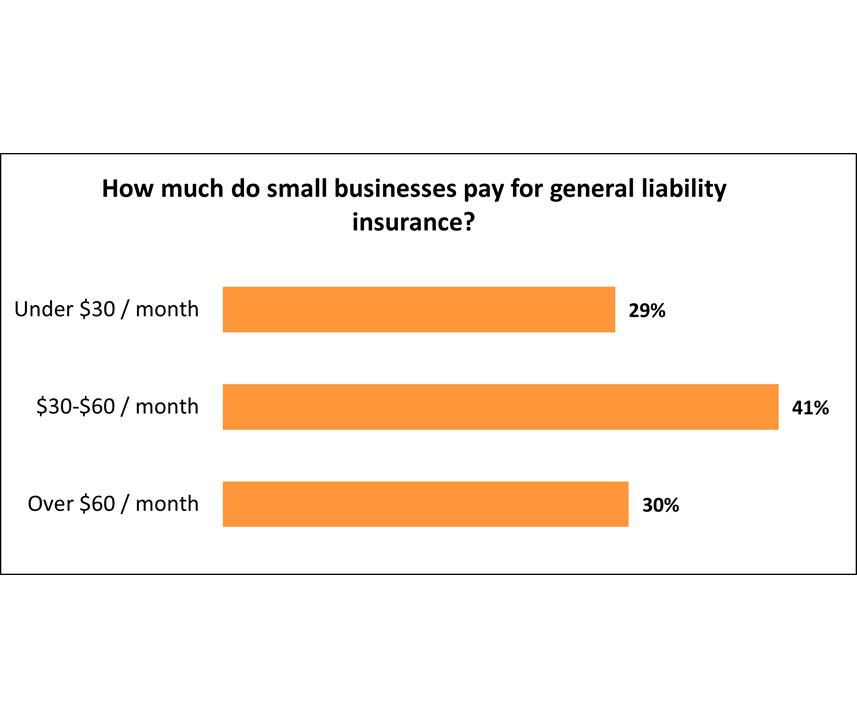

General Liability Insurance Cost Insureon

In The Aggregate Vs Any One Claim Whats The Difference Ashburnham Insurance

General Liability Insurance Everything You Should Know Landesblosch

The Difference Between Per Project Per Location Bcs University

What Is Damage To Premises Rented To You

Vendors Endorsement - Extend Coverage To Your Vendors

How The Limits Apply In The Cgl Policy Expert Commentary Irmicom

General Liability Insurance Cost Insureon

Mengenal Istilah Dalam Dunia Asuransi Versi Allianz Indonesia

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy

:max_bytes(150000):strip_icc()/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Corporate Insurance Policies Protect Companies From Loss

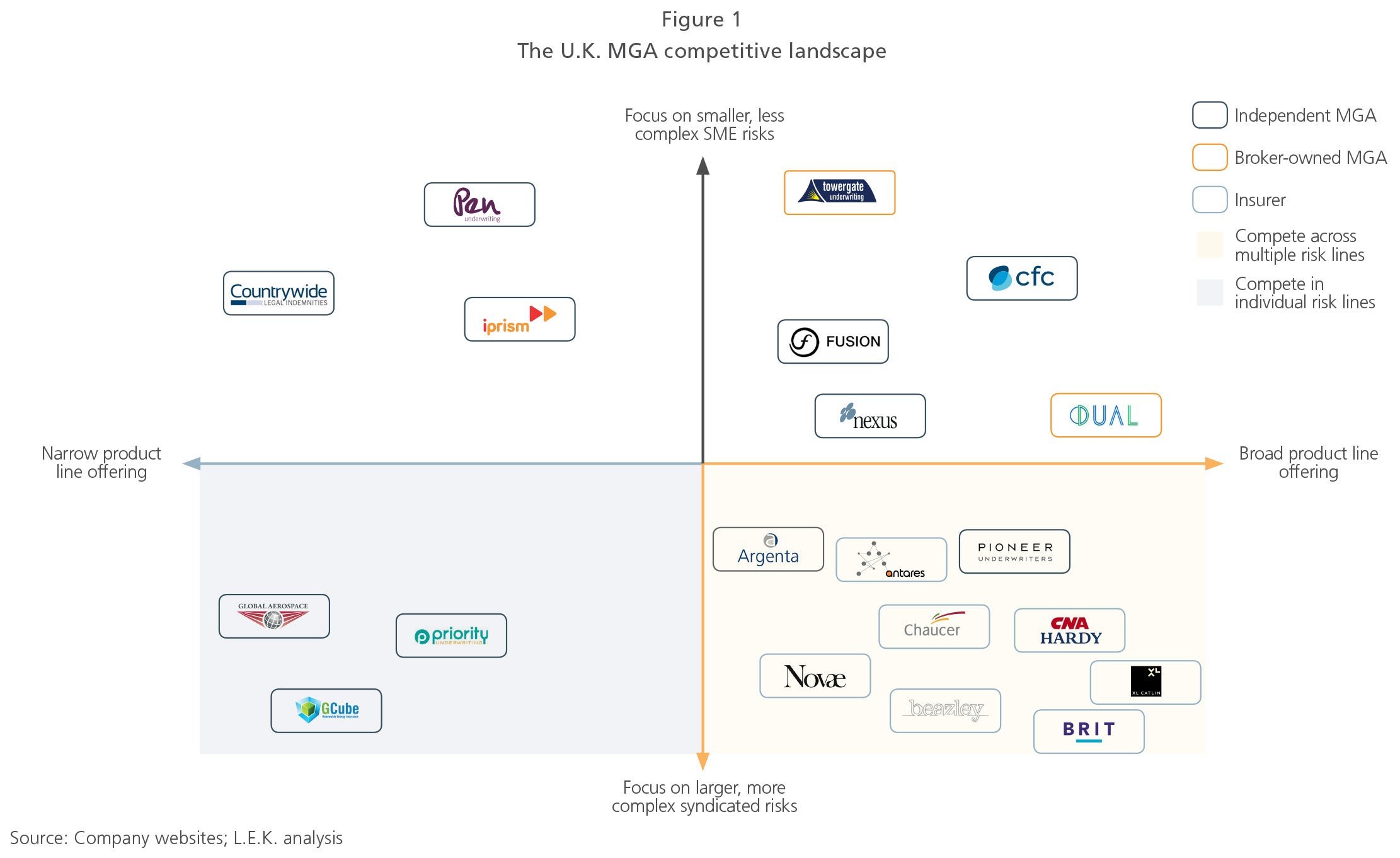

Are Independent Mgas The Future Of Underwritting

Claims Made Vs Occurrence Insurance Policies - Embroker

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy

/imitation-of-a-house-in-a-chain-on-a-lock-on-a-gray-piece-of-concrete-on-a-beige-pastel-background--1133455818-33c850555bb14795a46fade3d2e34a17.jpg)

/GettyImages-801982414-3919def938ba436e8a85ade3c6926bb6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1035834404-ec93fc4955fc43d7af41255df3578d94.jpg)

Posting Komentar untuk "General Aggregate Insurance Definition"