What Is Hazard Insurance Premium

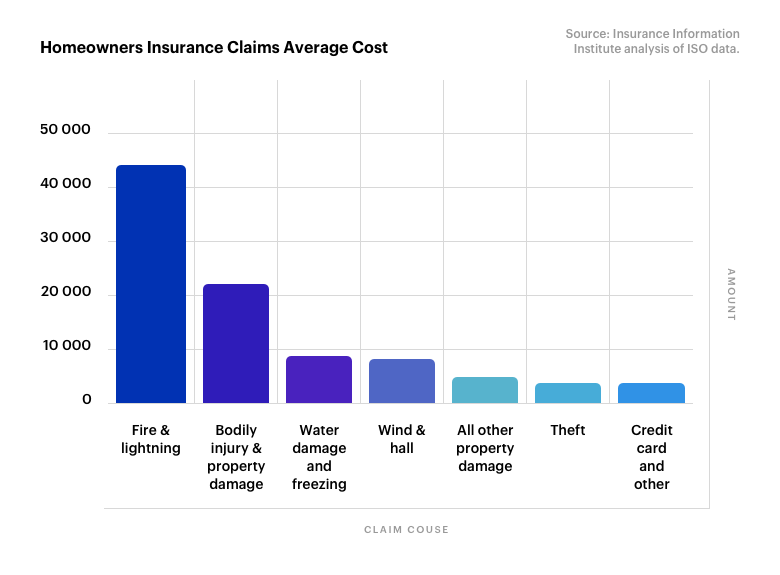

Choosing a higher deductible can reduce the cost of an insurance premium, but requires more money from the homeowner when filing a claim. With regard to wind/hurricane coverage, the maximum deductible may not exceed the higher of $2,000 or 2% of the face amount of the dwelling coverage.

Hazard Insurance Vs Homeowners Insurance Which Is Better Home Warranty

Insurance and flood insurance may not exceed the higher of $1,000 or 1% of the face amount of the dwelling coverage.

What is hazard insurance premium. It’s usually a requirement when qualifying for a mortgage. What doesn't hazard insurance cover? Hazard insurance is a type of policy that protects property owners against damages caused by natural disasters such as earthquakes, tsunamis, tornadoes, storms, and fires.

Hazard insurance policies have a deductible, the amount homeowners must pay out of their own pockets when perils strike. All decisions regarding any insurance products, including approval for coverage, premium, commissions and fees, will be. Get the best quote and save 30% today!

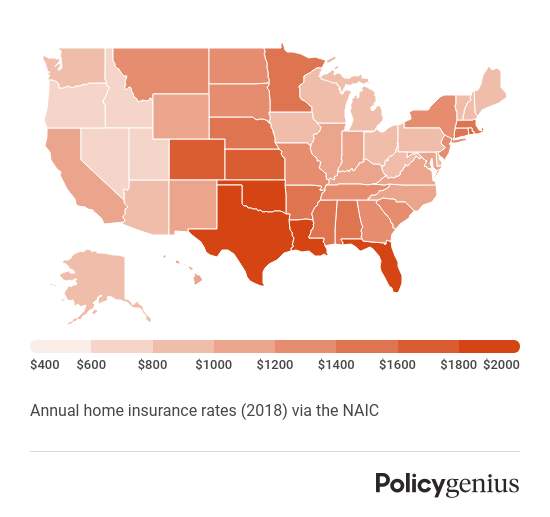

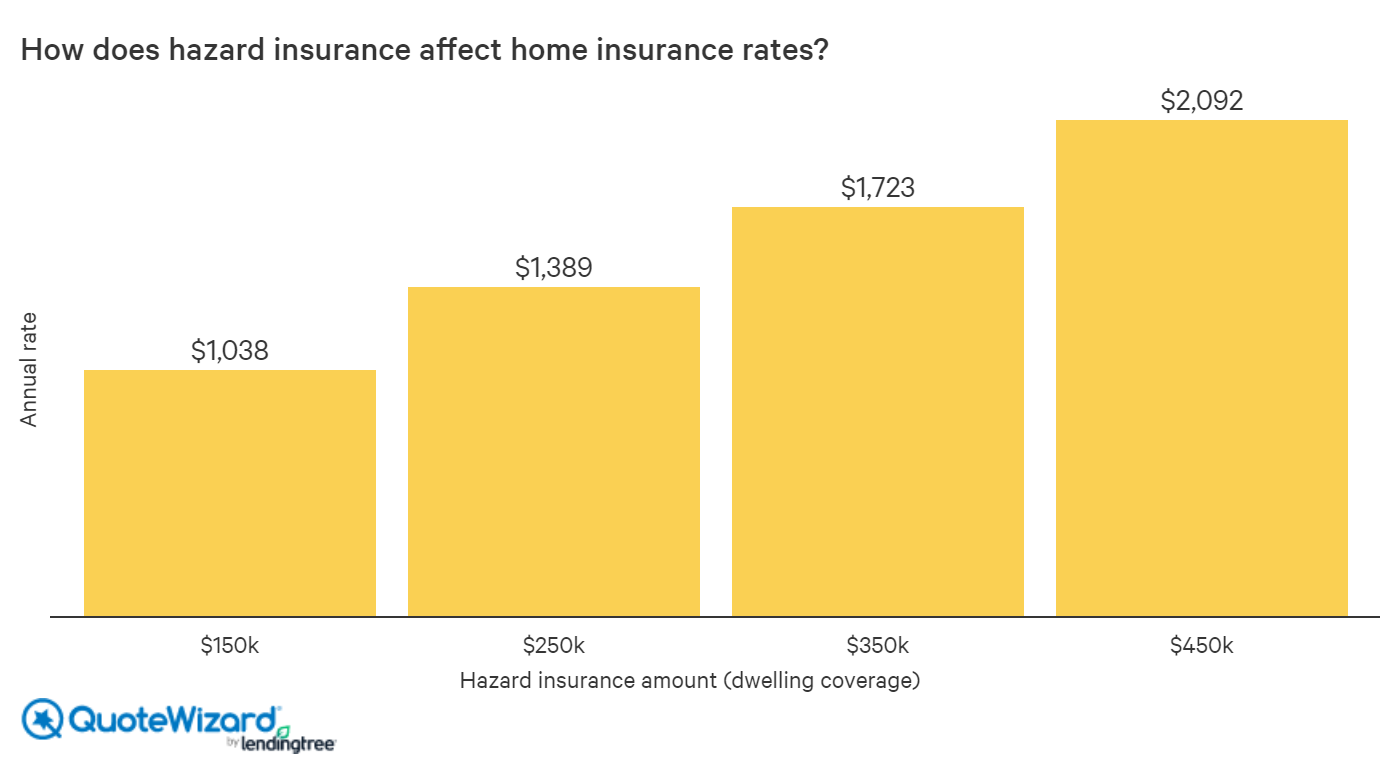

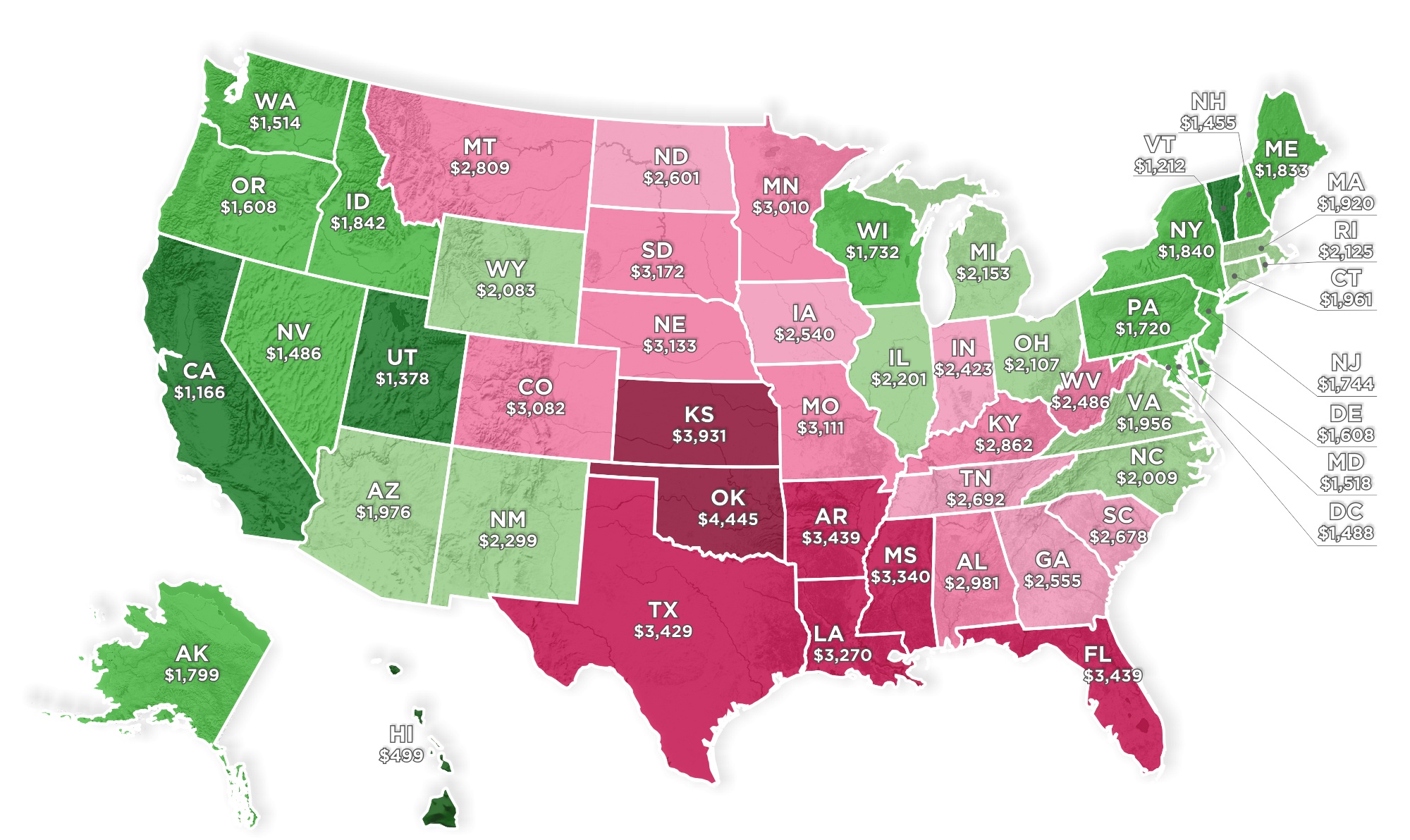

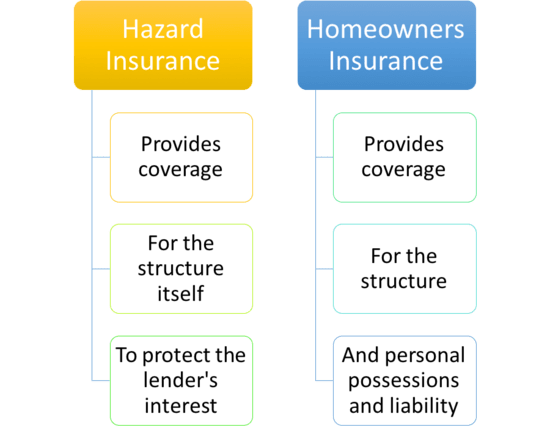

Your hazard insurance premium is based on your location and how much it would cost to replace your property in the case of a total loss. Homeowners insurance, both policies cover very different things. Hazard insurance, also called homeowner's or property insurance, provides coverage for specific natural hazards, such as fire, wind, earthquakes and vandalism.

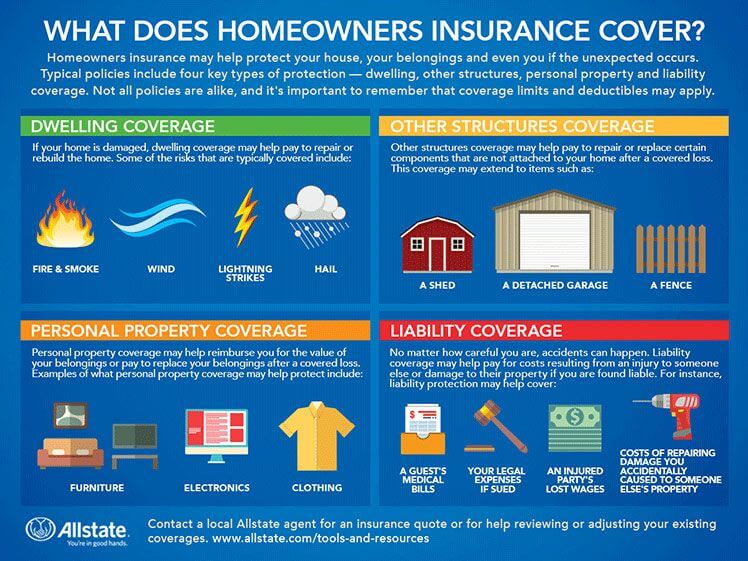

Many homeowners purchase a comprehensive form of insurance first, which may include most common damages, but then seek additional coverage for specific dangers. Hazard insurance covers the structure itself and none of your personal belongings. The hazard insurance premium is usually rolled into a homeowners policy, which protects you from liability claims.

Hazard insurance is the part of homeowners insurance that covers your home against natural hazards, including fire and wind damage. Sometimes referred to as dwelling coverage, it is not a standalone policy but rather a part of your overall homeowners insurance policy that also contains coverage for your personal belongings and liability coverage. Vehicles that run into your home;

The hazard insurance premium is usually rolled into a homeowners policy, which protects you from liability… considerations. The premium is set at the beginning… payments. What does hazard insurance cover?

Hazard insurance is required by mortgage lenders, but when it comes to hazard insurance vs. Hazard insurance protects your home from natural disasters or hazards. The hazard insurance premium is usually rolled into a homeowners policy, which protects you from liability claims.

The mortgage servicing company places the premiums in an escrow account and pays the insurance company on the premium's due date. You will need to purchase a separate flood insurance policy to cover your home. Insurance premiums are paid for policies that cover healthcare, auto, home, and life insurance.

Hazard insurance may cover “hazards” such as: Hazard insurance, coverage, and premiums. Get the best quote and save 30% today!

Hazard insurance is the part of your homeowners insurance that reimburses you for repairs or replacements if your home or its contents are damaged. Ad compare top 50 expat health insurance in indonesia. Some mortgage lenders require homeowners to.

Generally speaking, a hazard insurance calculator will value your policy at approximately 0.25 percent of your home's purchase price. Ad compare top 50 expat health insurance in indonesia. A premium is the regular payment required to maintain insurance coverage.

Read on to know more about hazard insurance's cost, how does it work, and what is covered. Hazard insurance is a valuable form of supplemental insurance that can be used to protect your property against a variety of serious and unexpected disasters. What is a hazard insurance premium?

Hazard insurance is coverage that protects a property owner against damage caused by fires, severe storms, hail/sleet, or other natural events. An insurance premium is the amount of money an individual or business pays for an insurance policy. Hazard insurance typically doesn’t cover damage from flooding.

Simply put, hazard insurance is the component in your homeowners insurance that covers your home’s structure. Here is an example of a named perils policy, listing what type of hazards it will protect against: Hazard insurance is the part of a homeowners policy that covers your home's structure against perils like water damage or fire.

Hazard insurance is not a separate policy from homeowners insurance; You will need a homeowners insurance policy to cover your home and your personal items within it. Hail, ice, snow, and sleet.

Property owners are entitled to receive compensation provided that the event is included in the insurance policy.

What Does Homeowners Insurance Cover Allstate

Hazard Insurance - Definition Overview How Does It Work

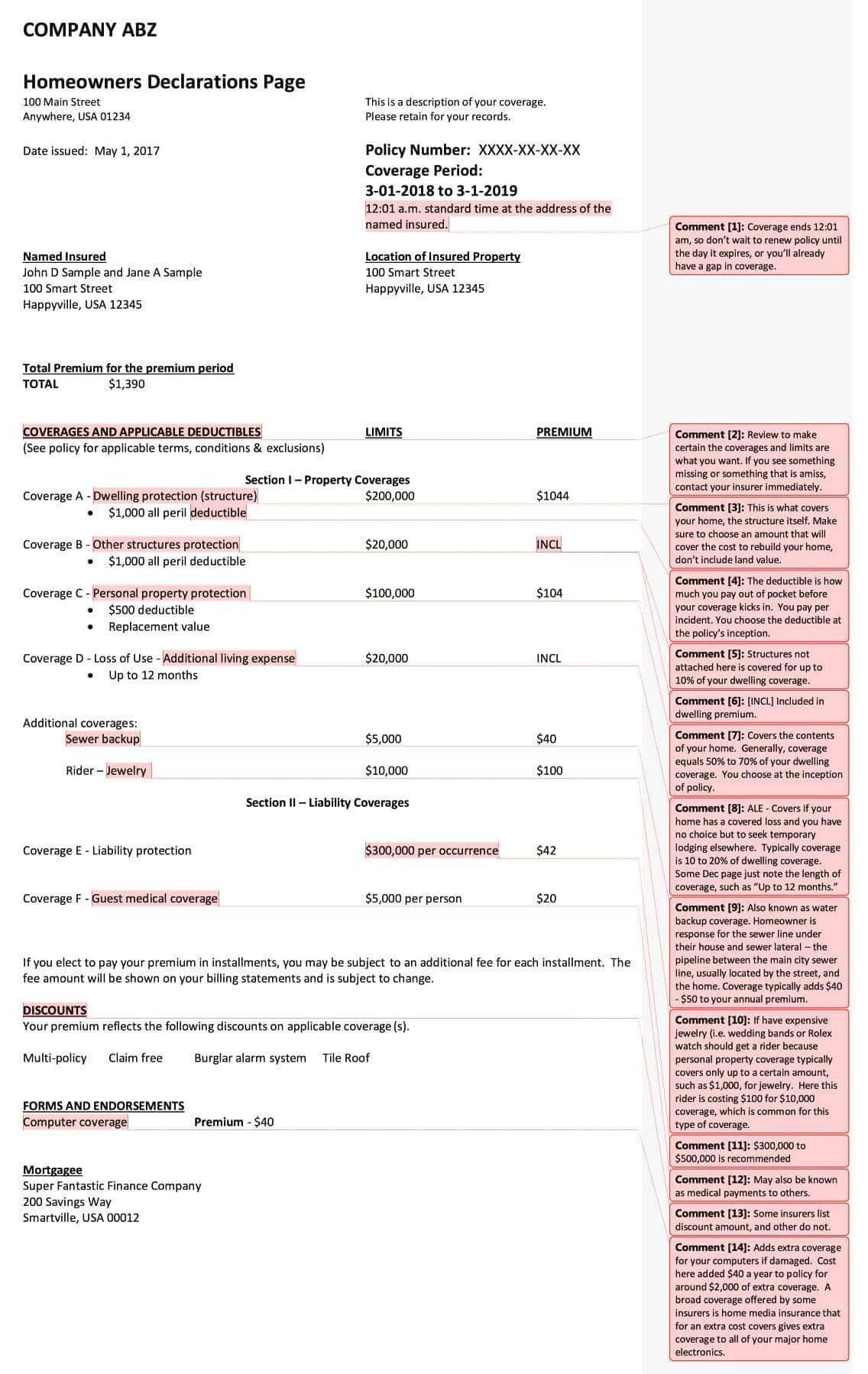

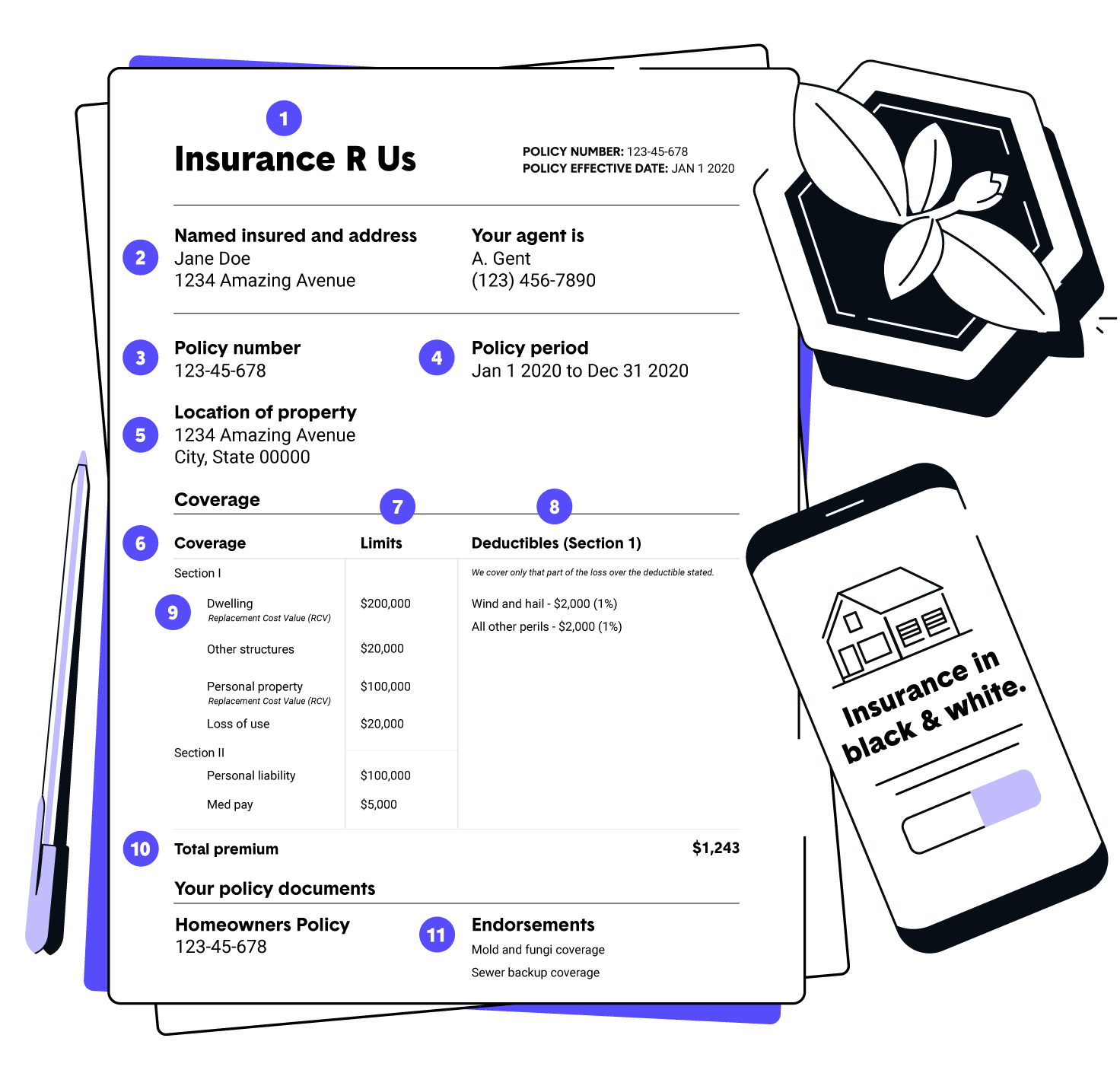

Understanding Your Home Insurance Declarations Page Policygenius

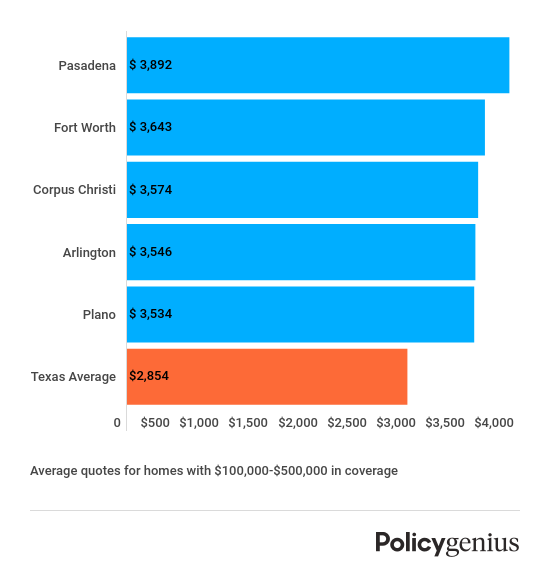

How Much Is Homeowners Insurance Average Insurance Cost In 2021 Policygenius

What Is Hazard Insurance For Homeowners Insurancecom

Average Cost Of Homeowners Insurance 2021 - Valuepenguin

The Cost Of Property Taxes And Hazard Insurance

What Is Hazard Insurance - Honest Policy

Hazard Insurance And How Its Related To Home Insurance Quotewizard

Mapped Average Homeowners Insurance Rates For Each State

Guide To Hazard Insurance For Homeowners Quicken Loans

Homeowners Insurance Declaration Page How To Read It

7 Best Homeowners Insurance Companies Of November 2021 Money

Hazard Insurance What Is It And Do You Need It - Cover

Hazard Insurance Vs Homeowners Insurance Thetruthaboutinsurancecom

Mortgage Company Wants Us To Pay Hazard Insurance Premium Up Front

How To Read A Homeowners Insurance Policy The Zebra

Best And Cheapest Home Insurance Companies In Arizona - Valuepenguin

Posting Komentar untuk "What Is Hazard Insurance Premium"