Property And Casualty Insurance Claims Processing

C asualty insurance helps protect you if you’re found responsible for accidents or events that result in an injury to another person or their property. Property and casualty insurance carriers can increase profitability through automation.

Ever Wondered How Insurance Claims Can Be Processed On The Blockchain Heres How By Triinu Murumaee Blackinsurance Medium

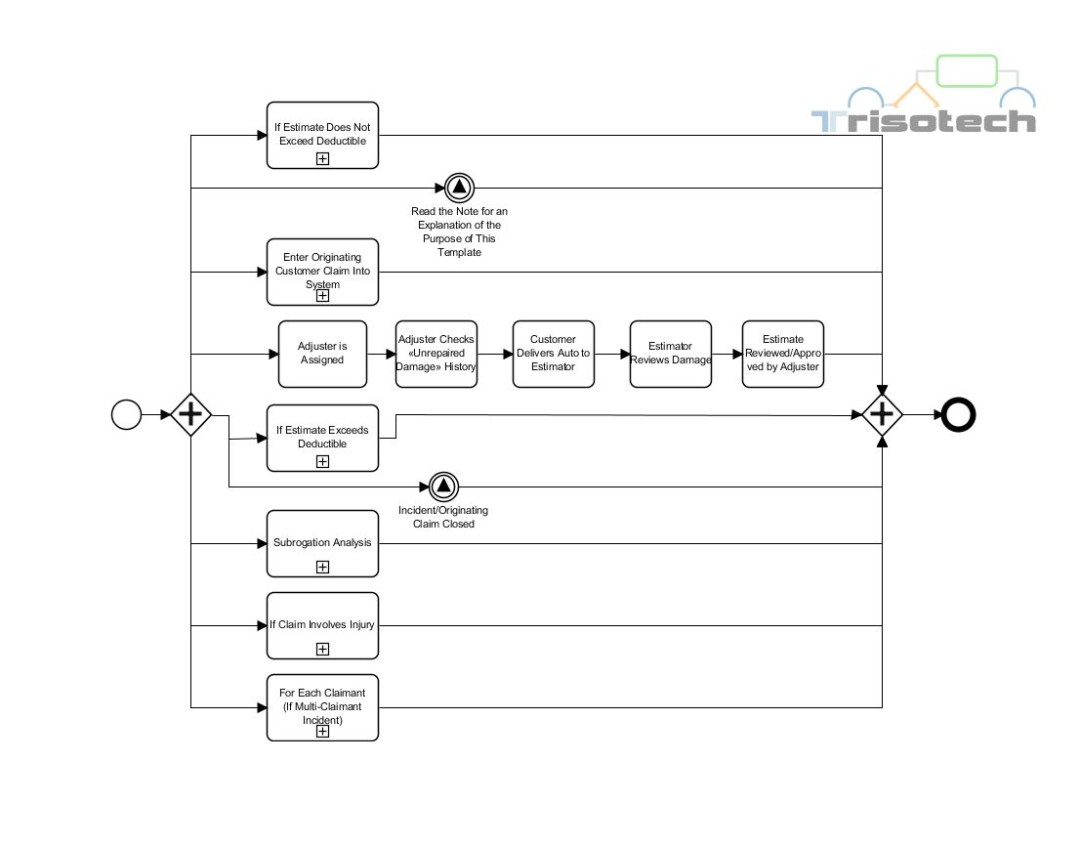

The insurance claims management process we follow.

Property and casualty insurance claims processing. Before, going ahead with any repairs or replacement of the damaged property, the insurance company should be notified with estimated quotations for the same. This environment is further challenged by the need to transform legacy. The claims process after you report a claim, you’ll be contacted within 24 business hours by one of our dedicated claims professionals.

Claim to the third party: Property and casualty insurance, or p&c insurance, is an umbrella term to describe a bunch of different types of insurance, covering your personal property and offering liability coverage. The benefits of straight through processing.

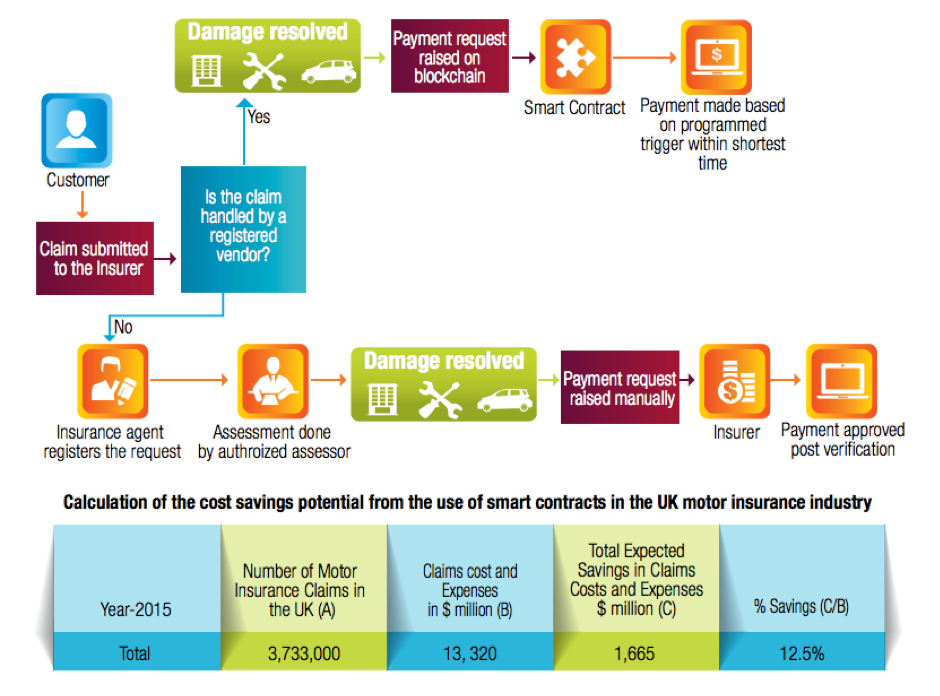

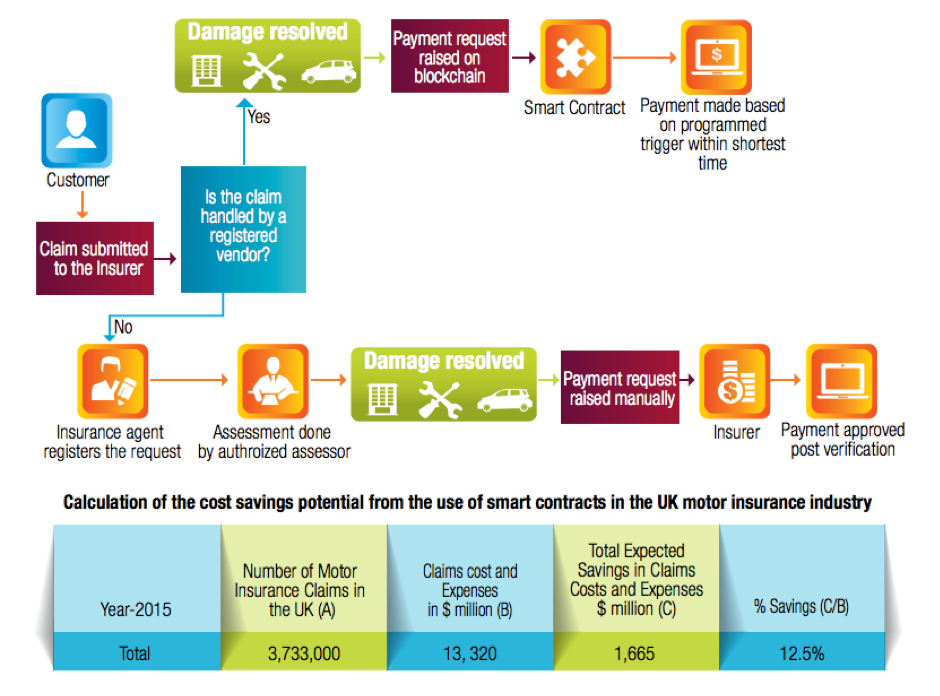

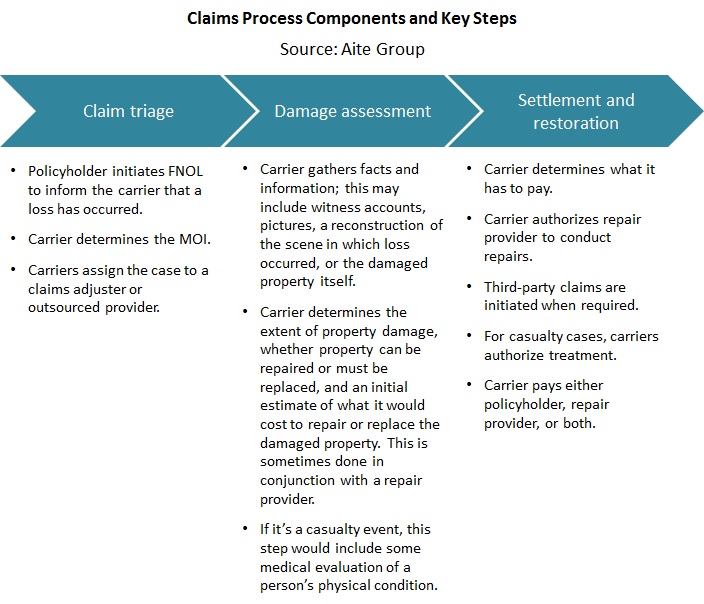

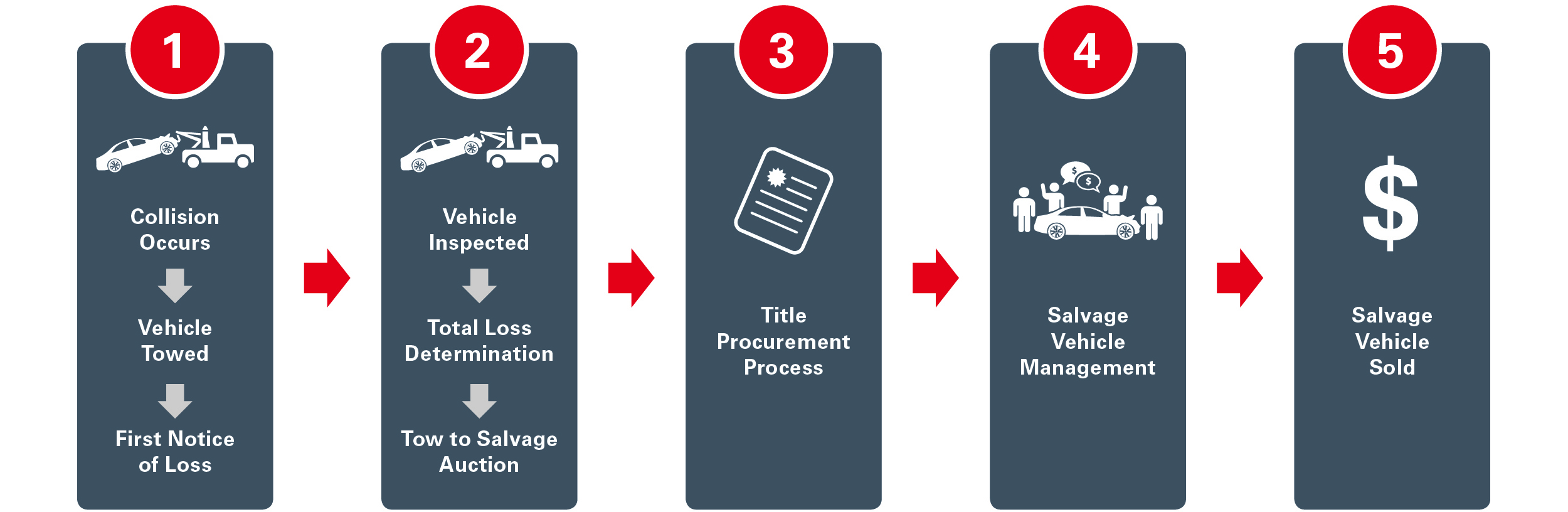

By implementing true stp automation in key claim activities (eg, fnol, document management, customer communications, fraud and subrogation predictive analytics,. Protection against a covered loss or damage to its physical location and property, as well as from liability claims against the business for bodily injury or property damage caused by. This process includes damage review (losses recorded, loss verification, etc.), assessment of coverage, field inspection (if necessary), adjustments, payment request (if approved) and client notification.

This property and casualty insurer speeds document capture processes by 40 percent to help teams handle claims quickly and efficiently. P&c insurance policies come in different types depending on various factors. Property and casualty insurance, or p&c insurance, is an amalgam of two types of insurance coverage.

Claims & policy management expedite p&c policy management and claim processing by replacing slow, costly manual processes with automated insurance workflows. Property and casualty insurance is an umbrella product that includes different forms of general insurance plans. What is property & casualty (p&c) coverage?

Of $694 billion as of 2020. We enable a gamut of solutions from processing claims, to setting up new policies, calculating risks through a team of trained actuaries, supporting sales and providing finance and accounting support. There are different types of property and casualty insurance policies that can offer protection against flood, fire,.

Intelligent document processing for property and casualty insurance how to automate p&c insurance processes involving unstructured documents to increase capacity and reduce costs insurance companies that deal with property & casualty policies know the business relies on vast numbers of documents and images, whether for underwriting, servicing policies, processing claims, or claims. Automating claims processing reduces costs and also streamlines workflow from initial claim submission to final settlement. As a property and casualty insurance quoting software, the agency management system comes with automated product pricing & quoting capabilities that help you ensure a better “prospect to customer” conversion rate.

If the damage is caused by the third party, then a claim should be sent to the third party for reimbursements as well as it should be notified to the insurance company. Our fluid process coupled with excellent transparency will clear the cloud around insurance claims management for property and casualty. Insurance claims processors, also known as claims clerks or examiners, decide whether an insurance company will pay a claim.

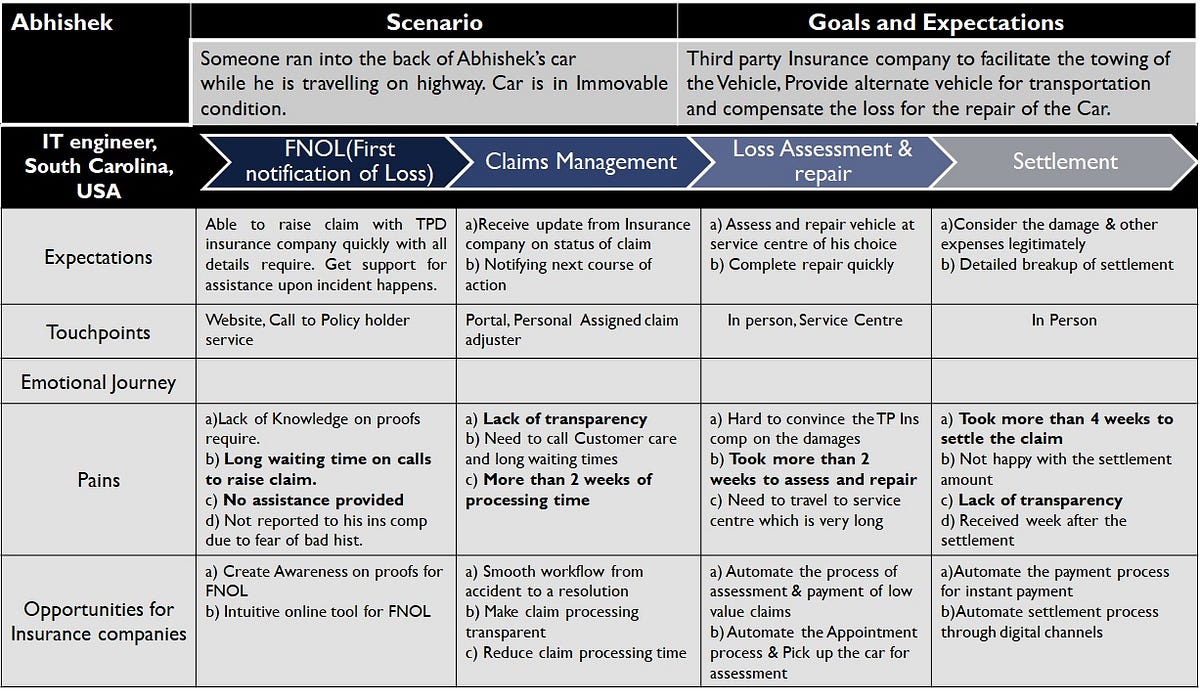

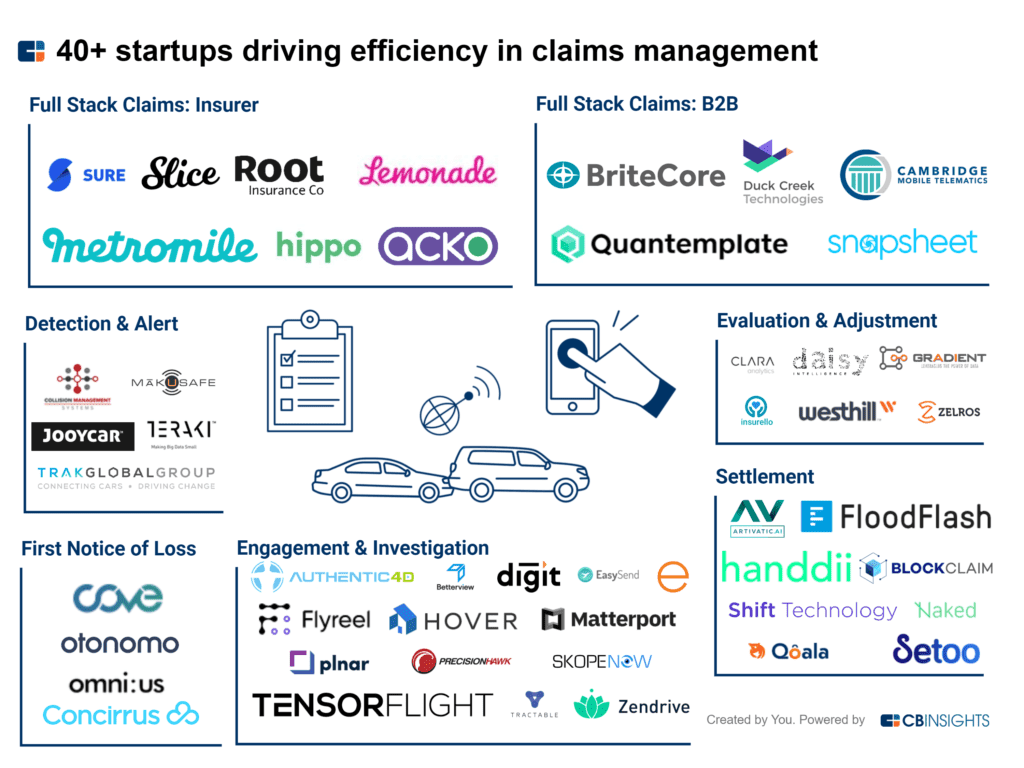

The pandemic has served as a catalyst for putting digital transformation across insurance on the fast track, and claims is one of the focus areas that is primed for implementing digital capabilities. These expectations include the ability to personalize insurance solutions and to increase efficiency around claims processing, claims payment and other transactions, according to a pwc report. Our dynamic claim management system with api connectivity brings quality and consistency to the claims process and enhance compliance.

Procedure for all types of property and casualty claims notification of incident, loss or damage when loss or damage under the insurance policy occurs, the insured should notify us of the incident as soon as possible.any loss or damage caused by theft/burglary must be reported to the local police precinct. Property and casualty insurer transforming claims management to speed processing times and sharpen customer service. Repairs and replacement of the property:

Insurance that provides a business with financial. Property & casualty claims is a process that involves receiving, processing and approving/denying property and casualty insurance claims. One of the key parts of an insurer's automation toolkit is to build out and embed straight through processing (stp) across the claims lifecycle.

This is because we aim to bring you the service you can trust with utmost accountability. Claims processing presents complexities and added overhead to every insurance company in the market. Influence claims outcomes and reduce claim.

These factors are the coverage offered, claims processing time, deductibles, mentioned limits, and more. With loss adjustment expense (lae) continuing to rise, claims costs continue to be a black hole for insurers. Please note that this coverage does not include life insurance and health insurance.

The global property and casualty insurance industry is challenged by increasing claims costs, increased regulatory compliance requirements, competition from innovative new market entrants, and commoditization by new buyers such as millennials. Wns brings unmatched domain capabilities to the p&c insurance industry. Property insurance helps cover personal and commercial assets such as your home or vehicle.

In fact, a 2018 study found that one in seven survey respondents said it took longer than expected to settle their property & casualty (p&c) claim, with delays adding to their burden. With automation, insurers can increase efficiency and

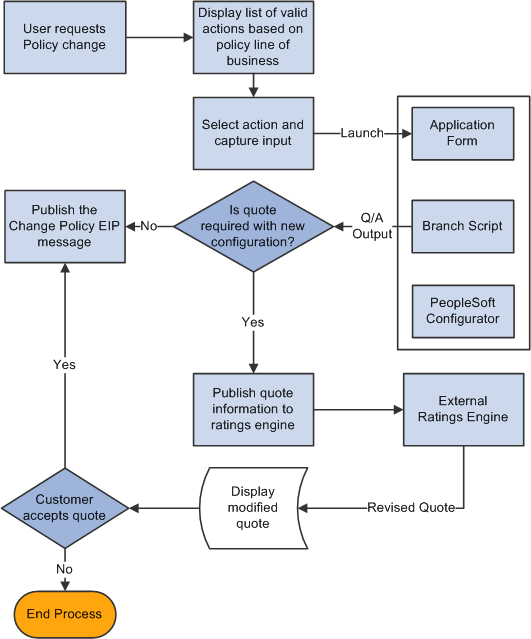

Peoplesoft Enterprise Policy And Claims Presentment 9 Peoplebook

Why And How Insurance Companies Can Digitize Claims Customer Journey By Teja Kancherla Medium

Property And Casualty Insurance Companies Top 10 Market Issues Revolve In Large Part Around Claims - Property Insurance Coverage Law Blog - Merlin Law Group

Overview In This Sample You Will Learn How To Develop Deploy And Run An Insurance Industry Specific Monitor Model Using Websphere Business Monitor Development Toolkit V62 On Either Rational Application Developer V751 Or Websphere Integration

Enhancing Pc Carriers Moment Of Truth Through Innovation In Claims - Insurance-canadaca - Where Insurance Technology Meet

Transform Your Claims Adjudication Process Through The Cognitive Insurance Platform Aws For Industries

Property Claim Next Steps Travelers Insurance

Peoplesoft Enterprise Policy And Claims Presentment 91 Peoplebook

Claims System Spectrum Asia-pacific Property And Casualty Insurance 2014 Celent

Quotes About Insurance Claims 33 Quotes

How Millennials Are Shaping The Claims Process And Why It Benefits Us All

Property And Casualty Insurance Claim Processing - Bpi - The Destination For Everything Process Related

Auto Claim Next Steps Travelers Insurance

Insurance Claims Processing Customer Experience First

Pc Insurers Face A Crisis Innovation Is No Longer Optional Cb Insights Research

Straight Through Claims Processing Insurance Automation

Claims In The Digital Age How Insurers Can Get Started Mckinsey

Tractable Announces Partnership With The Hartford To Accelerate Claims Processing With Artificial Intelligence

Posting Komentar untuk "Property And Casualty Insurance Claims Processing"