Fdic Insurance Limit Joint Account

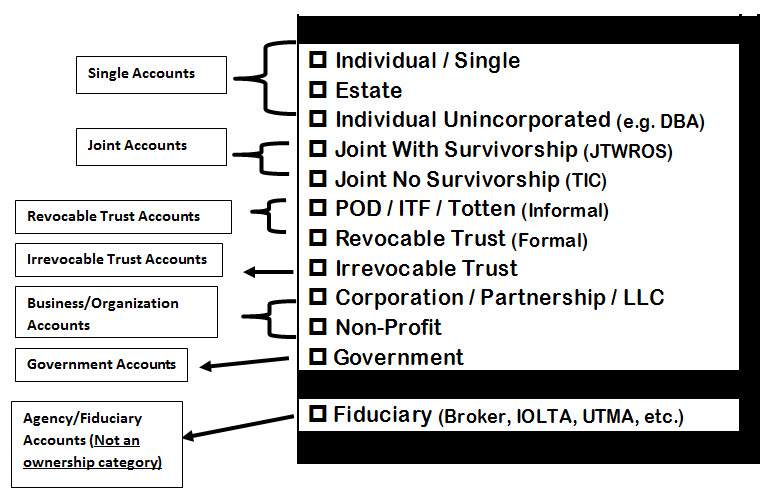

Coverage limits by account category. Fdic insurance does cover earnings on deposits, assuming the overall account value does not exceed the $250,000 insurance limit.

Money Therapy - Should I Follow The Money Personal Finance Articles How To Attract Customers Success Business

The standard fdic insurance limit is $250,000 per depositor, per insured bank, for each account ownership category.

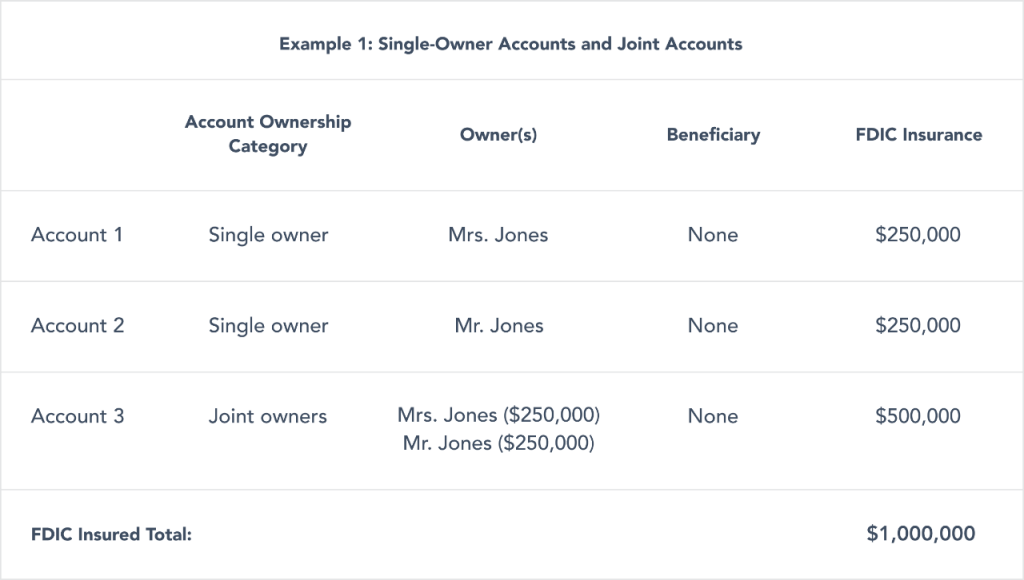

Fdic insurance limit joint account. One person can not have two individual accounts at one bank that are both worth $250,000 usd and expect them to be covered, though that same person could have an individual account, a joint account, be part of a trust, and seek coverage protection of $250,000 usd per account category. This means you and your spouse can get another $500,000 of fdic insurance coverage by opening a joint account in addition to your single accounts. That means you and your spouse could open an additional account—say, a joint savings account—at the same bank as your individual savings accounts and your retirement accounts, giving you a total of $1.5.

Joint accounts allow you to insure $250,000 for each account owner, up to $1 million at any individual bank entity. Who owns money in a joint bank account? An individual's interests in all joint accounts are added together and insured for up to $100,000;

Since the fdic insurance limit of $250,000 is per ownership category at each bank, you can easily maximize your coverage in one of two ways. As long as your financial institution is insured by the fdic, which insures bank accounts, or ncua, which insures credit union accounts, the coverage limits available from either federal agency will be the same, which is currently $250,000 per depositor, per financial institution (not per branch location). For example, if an account is held by a husband and wife, the account would be fully insured up to $500,000.

Joint accounts are insured separately from accounts in other ownership categories, up to a total of $250,000 per owner. And adding another joint account owner—like a parent—adds another $250,000 in coverage, and so on. This is their only account at this idi and it is held as a “joint account with right of survivorship.”

Open accounts in separate account categories: For six months after john’s death, the deposit insurance coverage is calculated as if john This means individual accounts and joint accounts can each receive $250,000 of insurance at an insured bank with a common account owner.

As with individual accounts, business accounts can also get fdic insurance of up to $250,000 per entity per bank. Each account holder is entitled to $250,000 of fdic coverage in single accounts and $250,000 fdic coverage in joint accounts. Under the old rules, no one joint account could be insured for more than $100,000.

Joint accounts joint accounts fall into a separate category, and they carry a $500,000 limit. For example, if you own a small business, you can open personal and business checking accounts and receive up to $250,000 in fdic insurance for each account. Are joint accounts fdic insured to 500000?

Each account category is typically considered separately when determining fdic limits. The rules regarding fdic insurance on joint accounts changed significantly in july, 1998. $250,000 per owner per unique beneficiary

The fdic protects consumers in the event of a bank failure, offering up to $250,000 in insurance coverage for each ownership category. A person's share in a joint account is not combined with the amounts owned in single accounts to come up with a total; What is the fdic insurance limit?

This is their only account at this idi and it is held as a “joint account with right of survivorship.” while they are both alive, they are fully insured for up to $500,000 under the joint account category. There is no limit on the amount. In other words, if you have a personal checking account, a personal savings account, a joint checking account, and a cd at your bank, each of those accounts is automatically insured up to $250,000.

First, you can deposit your money at different banks. While both owners are alive, the joint account is insured for up to $500,000 and susan’s single account is insured separately up to $250,000.

Comprehensive Deposit Insurance Seminar For Bankers Important This

Fdic Financial Institution Employees Guide To Deposit Insurance - General Principles Of Insurance Coverage

Comprehensive Deposit Insurance Seminar For Bankers Important This

Fdic Law Regulations Related Acts - Rules And Regulations

Fdic Deposit Insurance At A Glance

Deposit Insurance Offers A Safe Haven - The Cpa Journal

Maximizing Your Fdic Insurance - Cbs News

Bussenger Financial Group 855 Feinberg Ct Suite 113 Cary Il 60013 847 516-8062 Wwwbussengerfinancialgroupcom Financial Infographic Annuity

Fdic Financial Institution Employees Guide To Deposit Insurance - Deposit Insurance Basics

Fdic Fdic Consumer News Summer 2014 - The Fdic Enhances Deposit Insurance Information Online

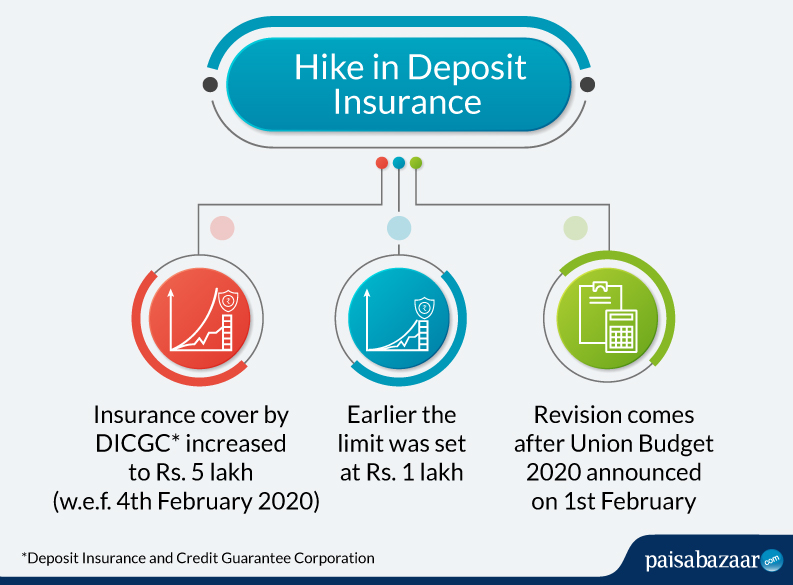

Dicgc Deposit Insurance Coverage Increased To Rs 5 Lakh I Paisabazaar

Fdic Bank Insurance Marcus By Goldman Sachs

Comprehensive Deposit Insurance Seminar For Bankers Important This

Learn How To Invest In The Stock Market Its Fun Online Stock Trading Online Stock Investing

Comprehensive Deposit Insurance Seminar For Bankers Important This

How To Maximize Fdic Coverage Ally

Posting Komentar untuk "Fdic Insurance Limit Joint Account"