Self Insured Retention Limits Work Like

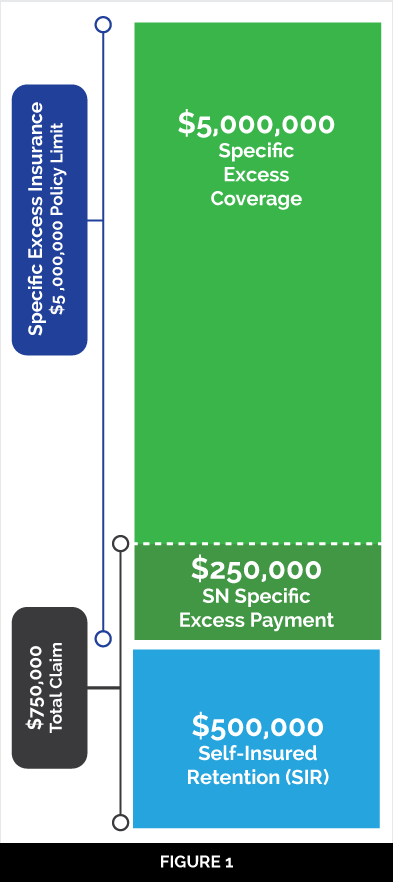

By taking on the role of managing any smaller claims before their insurance policy coverage kicks in, companies can take an active role in managing the risks of. Almost all umbrella policies contain aggregate limits that operate like the aggregate limits in the primary insurance.

Excess Liability Vs Umbrella Liability - Ppt Download

Further, an insurer cannot settle a.

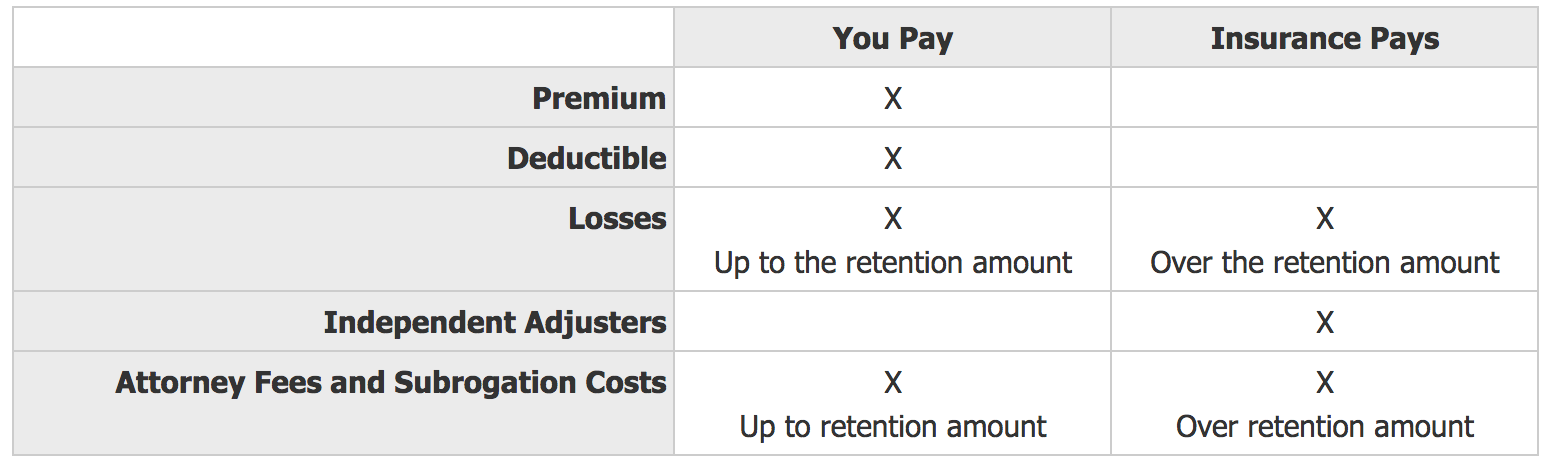

Self insured retention limits work like. An insurance has $300,000 of primary insurance and excess liability coverage of $1,000,000. P & c unit 16 checkpoint. Whether a company has a high deductible or an sir limit, the company, like an insurance company, can pursue tortfeasors to recover the amount of money the company paid.

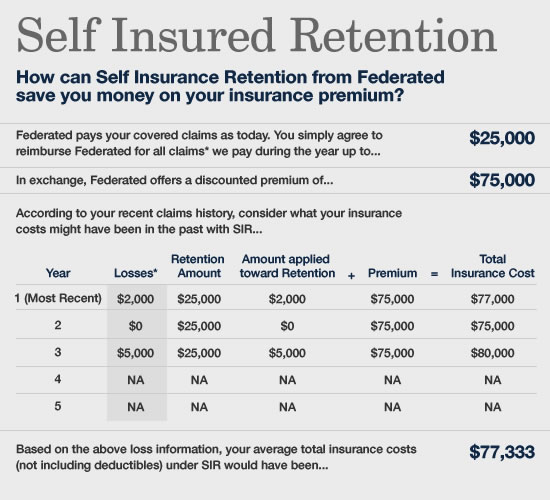

In both cases, you'll end up paying $50,000 for this loss to satisfy the sir/deductible and the insurer will pay the remaining $50,000. An organisation and an insurer both have an interest that it is set in an appropriate amount so that coverage can function as intended. If implemented correctly, it will encourage them.

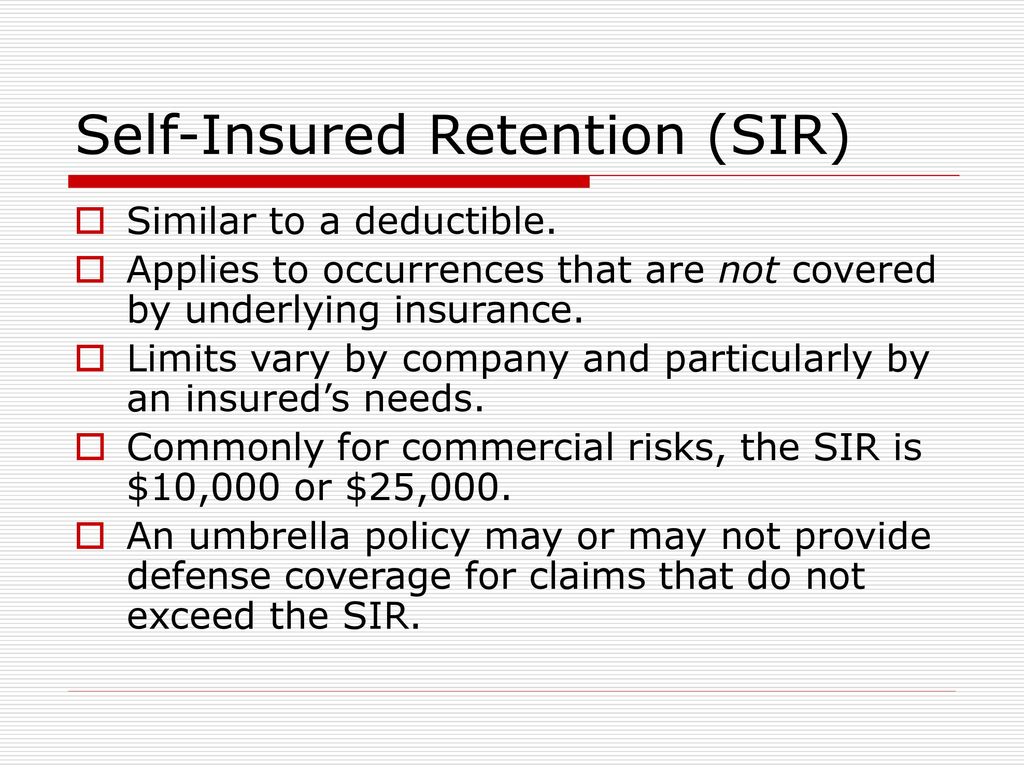

Auto dealers insured with federated insurance may be eligible to achieve this. Aggregate limits work the same way for all umbrellas policies d. Thus, under a policy written with a sir provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until the sir.

The aggregate limits never apply to coverages that are subject to an aggregate in the underlying policies. 44 votes) if an umbrella policy provides coverage for circumstances that are excluded by an underlying policy (such as personal injury under a homeowners policy), the insured pays a selected retention limit, typically between $250 and $10,000 which acts like a deductible, and the insurance company pays the loss over that amount. If the insured has a $350,000 claims, how much will the excess liability policy pay?

In case a business owner does not carry an underlying policy, they need to provide a sir of a. Richard is an actuary in the chicago casualty practice of milliman.he joined the firm in 2002. This set is often in folders with.

Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim.

Self-insured Retention Vs Collateral

Funding The Self-insured Retention Sir - Florida Construction Legal Updates

Self-insured Retentions Versus Deductibles Expert Commentary Irmicom

Sir A Profit Center For Your Business American International Automobile Dealers

The Corridor Self-insured Retention Expert Commentary Irmicom

What Is Self-insured Retention Insurance Advisorsmith

Deductibles Vs Self-insured Retention

Self-insurance Text Only Version - Safety National

What Satisfies The Self-insured Retention Expert Commentary Irmicom

Aon Professional Services - How Should Your Retention Be Structured Helping Professional Service Firms Optimize Retentions Applied To Their Insurance Coverages

Umbrella And Excess Five Key Issues Q The

The Corridor Self-insured Retention Expert Commentary Irmicom

Self-insured Risks - Captive Insurance 101

Managing Your Risk Self-insured Retentions Vs High Deductibles Propertycasualty360

Self-insured Retention An Alternative To The Insurance Deductible - Reshield

Sir A Profit Center For Your Business American International Automobile Dealers

Self-insured Retention What It Is And How It Works - Harris Insurance

Excess Liability Vs Umbrella Liability - Ppt Download

Policyholders Manage The Losses Within Your Self-insured Retentions - Sandrun Risk

Posting Komentar untuk "Self Insured Retention Limits Work Like"